Maharashtra Widow Pension The Maharashtra Widow Pension is a valuable financial assistance scheme initiated by the Maharashtra government to support widows in managing their basic needs. The aim of this initiative is to empower women …

This site(hindi yojana news) Specialized Government Schemes are designed for information. On this site we continue to share information for all the programs initiated by the Government of India and after we have been searching too much on this site, we do the truth and the right news. There are not people’s time to waste people and you should first provide up the newcomer scheme or old schemes. On this page with us, We will share all the information that the Government of India is providing by the Government of India. we will share all the information you are. The next update can be found first.

Here’s how to apply you to apply the eligibility to how the documentation of the required how can check your status online. Only on this page (hindi yojana news) , we are requested to read each of our articles carefully so that no information is missed by you and you cannot benefit from the program initiated by the Government of India if If you want to take advantage of every government of the Government of India and want to get full wire information, be connected with us.

Table of Content

PM Awas Yojana Urban 2.0 PM Awas Yojana Urban 2.0 (PMAY-U 2.0) aims to provide affordable housing to economically weaker sections (EWS), lower-income groups (LIG), and middle-income groups (MIG) in urban areas. The mission will …

WCD Delhi Recruitment WCD Delhi Recruitment 2024, Eligibility, Fee, Last Date, Apply Online The Women and Child Development Department of Delhi has launched the WCD recruitment notification to fill ninety two vacancies in more than …

Ladki Bahin Yojana App 2024 The Ladki Bahin Yojana is a government initiative aimed at providing financial support to women from economically disadvantaged backgrounds. In 2024, this program has been expanded with an online application …

Mahafood RCMS The Maharashtra Government has introduced the Mahafood RCMS portal to provide ration card facilities to the permanent residents of the state. Through this portal, citizens can apply for a ration card, check grain …

Ladla Bhai Yojana Ladla Bhai Yojana Maharashtra Eligibility:- The Maharashtra state government launched the Ladla Bhai Yojana Maharashtra. After a very positive result on the Ladli Behna Yojana, the Maharashtra state government is all set …

Majhi Ladki Bahin Yojana 4th Installment Date The Majhi Ladki Bahin Yojana is a government program designed to provide financial assistance to girls and women from economically disadvantaged families. The program aims to empower young …

MATES Scheme The Australian government has launched the MATES Scheme 2024 to provide work opportunities in Australia for university students and early-career Indian professionals. Under this scheme, eligible Indian professionals and university students will be …

Ladki Bahin Yojana November Installment The Maharashtra country authorities have introduced the Maharashtra Ladki Bahin Yojana November Installment Date of 2024. All the girl residents of Maharashtra kingdom who are chosen under the scheme can …

Mahafood RCMS Mahafood RCMS Registration Mahafood RCMS Registration (Ration Card Management System) is an online portal launched by the Government of Maharashtra to streamline ration card services and ensure transparency in food distribution. This platform …

Jan Dhan Yojana (PMJDY) is a financial program launched by the Government of India to provide financial assistance to the poor people of India. This program was launched by Prime Minister Narendra Modi on 15 August 2014. This program The aim is to provide financial assistance to the poor people of India keeping in view their needs.

Eligibility Criteria of PMJDY

Following are the eligibility criteria for opening an account in Pradhan Mantri Jan Dhan Yojana Must be a citizen of India. Age should be more than 10 years. Should not have an account in any bank.

Documents required of PMJDY

- Passport

- Driving license

- PAN Card

- Credit card

Pradhan Mantri Ujjwala Yojana (PMUY)

Pradhan Mantri Ujjwala Yojana scheme was launched in 2016 by the Prime Minister of India, Narendra Modi, this scheme was announced to distribute LPG keeping in view the needs of the poor people, and a quota of 80 billion rupees was announced in the scheme. The Government of India decided to distribute LPG connections to 50 million women. Under this scheme, the Government of India is also providing free gas cylinders to the poor people of India

How to Apply in PMUY

To apply for this scheme, women have to go to a distribution center near them, get the application form from there, enter all their details, and submit it to the distribution center. If you want, click on the link given below to download online and you can download the application form at home, fill it submit it to your nearest distribution center, and then start checking your application. If you are eligible for this scheme, you will be included in the subsidy.

Necessary Documents For (PMUY)

- Credit card

- AYC

- Ration card

- Permanent address

- Jan Dhan Bank Account No

- Details of all household members

Atal Pension Yojana (APY):2024

This government Atal Pension Yojana is based on the life insurance and pension program started by him. The main objective of this scheme is to keep in mind the needs and financial problems of any woman after the death of her husband. This program was launched in 2016. If the husband dies before the age of 60, these women will be provided with an amount of Rs.1,000 to Rs.5,000 per month.

Benefits

Under this scheme, after the death of their husbands, women are given an amount of Rs.1,000 to Rs.5,000. This amount will be transferred to the woman’s Jandan bank account every month.

How to submit an offline application

First of all, you have to go to any nearby bank in which you have an account open where you will get a form this form is available in all languages which is your language get the form according to your language on the form After doing this, submit it to the same bank, your registration process will be completed and remember to submit your application along with the form.

Chart Of Atal Pension Yojana (APY)

Pradhan Mantri Owais Yojana Scheme 2024

The Pradhan Mantri Owais Yojana scheme was launched in June 2015 by the Government of India with one of the objectives being to build ready houses for the poor population of India who do not have their own houses and the hardships of life. The scheme was launched under two categories Pradhan Mantri and Yojana Urban and Pradhan Mantri Owais Yojana Rural.

Pradhan Mantri Owais Gojana Urban Scheme

Pradhan Mantri Owas Yujan Urban Scheme was launched on June 25. The objective of this scheme is to remove the reason why people do not have their own houses, to provide them with ready-made houses, and to remove the shortage of houses. Fazil Hardeep Singh Puri announced on 31 August that an index of 19 crore houses would be provided under the Pran Mantri Owais Yojana scheme to provide facilities to the poor.

Pradhan Mantri Owais Yojana Rural Scheme

This scheme was launched by India on 1st April 2016. Under this scheme, it has been decided to provide facilities for the poor people in Dahi Bus to the local people whose houses are poor Answer: Hindne Pradhan Mantri Owais Yojana Under the scheme, it has been decided to provide ready-made houses to all the people and it has also been announced by the Government of India to be implemented in March 2024. We provide 2.5 crore ready-made houses to the people living in it to live their lives safely and securely and bring their lives to Basani.

How to Apply

First of all, let me tell you the online method I first go to the official website of the government and then go to all the sisters in the fishery category, there is a form after entering all the details and then clicking on submit. Remember that you have entered all your details correctly, in case of an error, you will receive a confirmation message as soon as you register, and click on the ‘Submit’ button. If you were eligible, you would have been enrolled in the scheme.

Pradhan Mantri Suraksha Bima Yojana PMSBY)

Pradhan Mantri Suraksha Bima Yojana Scheme The Government of India launched this scheme in 2015. The scheme is named the Suraksha Bima Yojana Scheme. For such people, the Government of India has launched an insurance policy under which these people will be fully assisted to meet their living needs and the lives of those who will die in an accident. Assistance will be provided to the partner. This scheme is also named as PMSB Bai. People between 18 to 70 years old can apply to this scheme. Under this scheme, by depositing Rs.12 per annum, you can get insurance coverage of Rs.1 to Rs.2 lakh in case of accidental death or total disability.

Necessary documents

Proof of Identity, Credit Card, Phone Number, Full Address, Email ID, Ration Card,

How to Register in (PMSBY)

The procedure of registration in the PMSBY scheme is very simple and easy. To register in this Scheme, first of all, you have to go to your nearest bank or go to your insurance office from there you have to fill out a form. After entering all your information on it, you have to attach a copy of your identity card with it. Remember that whatever information you write must be correct and if you write wrong information, you will not be registered. After writing all the information and attaching a copy of the identity card, this form has to be submitted to the same bank or in the office of the insurance company and your registration process will be completed and you will receive a confirmation soon. The message will be sent. If you want to download the registration form, you can download the registration form from the official website of the government and after filling it, submit it to the nearest bank or insurance office.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Jeevan Jyoti Bima Yojana Scheme (PMJJBY) Launched by the Government of India in 2015, this program is an insurance scheme and is a life insurance scheme in case of sudden death or total disability. Assistance is provided under this scheme. The scheme is attached to various banks in India whose through-ups can be registered and become a part of the scheme and get assistance in an emergency. In case of sudden death of a person. If it happens, his family will be given up to two lakh rupees. After registration in this scheme PMJJBY, three months of Rs 436 will be deposited in the bank and after that, if any accident happens to a person, Two lakh rupees will be given by the government.

Who can apply to PMJJBY?

Those who are between 18 years to 50 years of age and have an ID card can apply for this scheme and all those who have an account in any bank can also apply for the scheme. Those who are above 50 years of age are not eligible for this scheme; only those above 18 years and below 50 years can apply for this game. A bank account is required to apply and the bank account must be linked to an Aadhar card.

Sukanya Samriddhi Yojana (SSY)

The main objective of Sukanya Samrudhi Yojana (SSY) is to fund the education and marriage expenses of girls.

In this scheme, parents or guardians of the girl child can invest regularly, and on maturity, they get back the principal with interest.

An interesting thing. Whatever money you earn in Sukanya Samrudhi Yojana, you don’t have to pay any tax on it.

That means risk-free, tax-free savings for your daughter! Sukanya Samrudhi Yojana account opening date matures after 21 years. If you opened the account when your daughter was 5 years old, the account will mature when your daughter turns 26 years old. By investing in Sukanya Samrudhi Yojana, you also get a better interest rate than bank FD or other government schemes.

The interest rate on the 2021 Sukanya Samrudhi Yojana remained unchanged at 7.6% p.a. But for the quarter of April to June 2023, the interest rate has been 8 percent per annum. The government changes this interest rate quarterly.

Account Opening Process

Currently, there is no online process to open an account, someone at your bank or post office opens an account

have to go

Let’s understand the step-by-step process.

Go to your nearest bank or post office, and fill out the Sukanya Samrudhi Yojana form there.

If you prefer, give this form to RBI, or India Post, or download and fill it out from the websites of participating private and public sector banks.

Along with the form you have to submit some documents like your daughter’s birth certificate,

Identity proof of parent or guardian like PAN and Aadhaar card, and proof of address like electricity bill.

After submitting the documents and forms you have to make your first deposit.

You can transfer it by cash, check, demand draft, or online.

And that’s it. The post office or bank will process your application open a Sukanya Samrudhi Yojana account, and also issue a passbook.

Note that the Sukanya Samrudhi Yojana account can be easily transferred from one post office or bank to another post office or bank.

Suppose you are shifting from Delhi to Mumbai, then you can transfer your Sukanya Samrdhi Yojana account from Delhi to the Mumbai post office or bank.

Sukanya Samriddhi Yojana calculator

If you also want to do this calculation yourself, you can find the Sukanya Samrdhi Yojana calculator link given in the description.

There are very few investment options in the market today that give a guaranteed risk-free 8% return.

The best part is that this investment also gives you tax benefits. Let’s understand.

See, the Sukanya Samrudhi Yojana not only offers 8% risk-free interest, but the returns are also completely tax-free.

Sukanya Samrudhi Yojana is one of the few special schemes that fall under the category of Triple E ” ie Exempt, Exempt, Exempt” investments.

The first E means that whatever amount you invest in Sukanya Samrudhi Yojana every year, that amount will be deducted from your taxable income.

For example, if you invest Rs 50,000 in a Sukanya Samrudhi Yojana account every year, then under Section 80C, Rs 50,000 will be deducted from your taxable income. The second e means that whatever interest you earn, there will be no tax on it. And the third E means you don’t have to pay any tax on the final amount which will be paid on maturity. Now one thing must be understood here.

Whether you open a Sukanya Samrudhi Yojana account or not, the maximum tax deduction you can get under Section 80C is limited to Rs 1.5 lakh.

Deen Dayal Upadhyaya Antyodaya Yojana (DDUAY)

The government is running a scheme to provide financial assistance up to ₹ lakh in case of sudden death of a BPL family member and not only this, financial assistance will also be provided in case of permanent disability under this scheme. The name of this scheme is Deen Dayal Upadhyay Antodaya Parivar Thaksha Yojana. It is also known as Dayal Yojana. To avail of this scheme you can easily apply from your home through your computer or mobile in just two minutes.

Let’s know about this scheme first. For this, I suggest you visit the official website of this scheme. On the home page of this site, you will find many options. Complete information about this scheme is given in the section about other options. The families whose annual income is less than 80000 or in other words the families who fall under the BPL category, will be given financial assistance by the government in case of death or permanent disability of any member of such family.

How to Apply Online

What is the step-by-step procedure to be followed to apply online? For this, click on the third option Apply Scheme on the home page.

Tick in front of the first option. Enter the family ID of the applicant and then click on Get OTP.

An OTP will be sent to the mobile number registered in Family ID through the system. Enter the OTP and click on Submit OTP.

After that the details of the family will be displayed according to the family id and the names of all the family members will be displayed here.

To select a beneficiary’s name, click the Select button in front of the beneficiary’s name in the last column.

After that, you will see two options, in case of death, tick in front of the first option and in case of disability,

Enter the date of death in the first point on the next page. Next, enter the registration number.

Check the registration number from the certificate.

The next point asks whether the certificate has been issued in Haryana. Tick Yes or No as appropriate.

Select your district name. In the next point, select your block name in the rural area and your town name in the urban area.

Similarly in the next point select your ward number in the urban area and select your village name in the roller area. Accordingly, type the name of the issuing authority.

After that, upload the death certificate here and keep in mind that its maximum size is 200 KB.

After that, click on Apply Scheme to accept the declaration in the last point.

You may see that the system has given a message that your application has been taken

Stand Up India Scheme

Stand Up India Program Launched by the government in 2016, this program provides loans up to Rs 1 crore to the people of India without any interest. How to Apply Eligibility Criteria We are telling you all the details to apply you first go to the official website of the Government of India. There you will be shown the Apply Now button, click on it and enter the amount as per your requirement, enter your phone number, email ID, and credit card number, and then click on your mobile number. After entering the OTP, click on submit, and will contact your nearest bank soon after completing the paperwork, you will be provided with the loan. The status is obvious, you can get this loan only for business. It will be provided to you for seven years. You have to repay this loan in seven years. After that, you must have a credit card to get the loan. You can’t get a loan without a Dhar card. To get a zone, you have to pledge some things to the bank. What should be the value of the things? It depends on your loan, and how much you want to get a loan.

National Urban Livelihoods Mission

As in our Government Schemes series, last time we looked at Deen Dayal Antyodaya Yojana, National Rural Livelihood Mission. So in this video, we are going to see Deen Dayal Antyodaya Yojana, National Urban Livelihood Mission. So before looking at this scheme, where this scheme started, and what is the history behind it, we will explain each scheme one by one.

Nehru Rozgar Yojana

So the first scheme in this is Nehru Rozgar Yojana. This scheme aimed to eradicate poverty by providing employment to the urban unemployed. In which 60% of the expenditure is borne by the central government and 40% by the state government. The Nehru Employment Scheme of Urban Micro-Enterprises was the objective of the scheme. Providing financial assistance to urban self-help groups for setting up micro-enterprises with a maximum limit of Rs.

UPA Scheme

Another UPA scheme was the Scheme for Urban Wage Employment, meant to provide wage employment to urban and skilled workers.

Sub-Scheme Housing

The third sub-scheme was the Housing and Shelter Upgradation Scheme, under which the houses of the weaker sections were improved and wage employment was created. By building houses. Shree Yojana, which means Urban Basic Services for the Poor, was launched in 1990 and aimed to improve the standard of living of the people by providing social services and material amenities, with 60 percent of the cost borne by the central government. was Government and 40% from the State Govt.

The third scheme was the Pradhan Mantri Yojana, which provides basic amenities to the urban poor and the Pradhan Mantri One Way Urban Poverty Eradication Programme. All these three schemes were integrated to provide relief to the public.

The Swaran Jayanti Urban Employment Yojana was launched on 1 December 1997 and aimed at providing productive employment to the urban unemployed by setting up self-employment schemes and providing wage employment. 75% of the expenditure was borne by the Central Government and 25% by the State Government.

The Swaran Jayanti Shahri Rozgar Yojana was implemented in the cities which were included in the 1991 census. The five main components of this scheme are 1st Urban Bank Employment Programme, 2nd Urban Sales Employment Programme, 3rd Skill Training for Employment Promotion Program and 5th Urban Community Development.

The Swaran Jayanti Shahri Rozgar Yojana was redesigned and renamed the Shri Rashtriya Shahri Ajivika Mission and the National Urban Livelihood Mission was launched in cities with a population of over one lakh as per the 2011 census. Along with this, Deen Dayal Antodia Urban Scheme was launched on 25 September 2014 to 20 February 2016 and aimed to provide skill training and employment to urban youth.

The scheme had six main components, first skill development, second to encourage others for self-employment, third to establish urban livelihood centers, fourth to support self-help groups, fourth to develop markets and fifth to promote employment. Providing opportunities. Later on 19 February 2016, National Urban Livelihood Mission and Deen Dayal Antodia Urban Scheme were merged and the mission was named Deen Dayal Antodia Yojana. The National Urban Livelihood Mission was also implemented in all cities under the 2011 census, with 60% of the cost borne by the central government and 40% by the state government.The objective of the scheme was to reduce poverty and insecurity, secondly to provide opportunities for gainful self-employment and wages. Thirdly, to improve the lifestyle and fourthly to build strong institutions of the urban poor. Under this scheme, the government launched a PARS portal called Personalized Training and Rapid Assessment System to provide feedback to beneficiaries after skill training. It was the Deen Dayal Yojana National Urban Livelihood Mission.

Agriculture and Rural Development Schemes

Pradhan Mantri Fasal Bima Yojana (PMFBY)

The Government of India started the Crop Bama Yojana in 2016. The objective of this scheme is to provide financial assistance to the farmers whose crops are destroyed due to landslides, earthquakes, cyclones, droughts, etc. The Government of India has started this scheme to compensate the farmers whose crops are destroyed. This scheme was started by Narendra Modi so that the farmers of India do not suffer any loss. We are sharing the procedure and eligibility criteria and necessary documents with you

Documents required to apply in this scheme

Loan Card, Email ID, Mobile Number, Electricity Bill, Address Proof, PAN Card,

How to apply in this scheme is very simple and easy, just click on the link below, you will be landed on the official website launched by Upcornment of India, after filling all your details, submit. Click on the button and your online application will be submitted. If you don’t submit your online application, visit your nearest bank now and apply from there.

Pradhan Mantri Krishi Sinchai Yojana (PMKSY)

Today we are going to talk about Pradhan Mantri Krishi Sahay Yojana, what is this scheme, who will benefit, how much subsidy, what documents are required, and where to fill out the form, I am going. Let me tell you all this in detail today, this scheme is an ambitious scheme to revolutionize the lives of farmers, the main objective of which is to provide water. Under the scheme of up to every farm and doubling of farmers’ income, the government also provides various forms of assistance for irrigation such as micro-irrigation, water reservoirs, construction and renovation of canals, and assistance to farmers for irrigation. The Pradhan Mantri Krishi Sahay Yojana provides that it will not only help increase the income of farmers but will also play an important role in conserving water resources and balancing the agricultural sector.

Documents required to apply (PMKSY)

What are the documents you need under this scheme, under the document you will need an Aadhaar card, passport-size photo, bank passbook, proof of residence, caste certificate, and agricultural land certificate,?

Subsidy details (PMKSY)

How much subsidy is available under PMKSY, friends, micro irrigation means micro irrigation, so first of all understand what micro irrigation is, micro irrigation is a modern method of applying drip sprinkle force to the land. irrigated through other subsidized sources. It is given at 55% for small farmers and 45% for other farmers. Under this farm water management scheme, a 60% subsidy is given to small farmers and a 40% subsidy to other farmers.

What about other farmers, friends, who do lift irrigation from the lower level to the upper level of their field by pump or other mechanical method, also known as lift irrigation, a subsidy is 90%. How do all farmers apply for subsidies? Farmers have to contact their local Agriculture Development Officer i.e. DA. Your application will be checked by the DO. If everything is found correct there, you are given subsidized wages.

Pradhan Mantri Kisan Samman Nidhi (PM-KISAN)

There are about 20 crore farmer families in our country. The central government is continuously working in the interest of farmers. Many schemes have been launched for them since 2014. It aims to increase the income of farmers. But Pradhan Mantri Kisan Samman is a scheme that directly benefits the farmers. In this, cash is deposited directly into the bank accounts of the farmers. That is, there is no need for any broker or middleman.

We all know that many times farmers do not have time and money to complete the necessary farming work. The government has understood his concern and since the inception of Pradhan Mantri Saman Nidhi, he is also known as PM Kisan. Under PM Kisan, Rs.6000 is collected directly at home per year for a farmer family. So that the farmer’s family does not have to wait for a year for the money, the money is deposited twice. That means 2000 rupees reach the farmer’s family every month. With this money, he can buy fertilizers, pesticides, or any other necessary goods.

The scheme has left families with around Rs 12 crore. The definition of family includes husband, wife, and minor children. So far 1 lakh 60 thousand crore rupees have been given to the farmers.

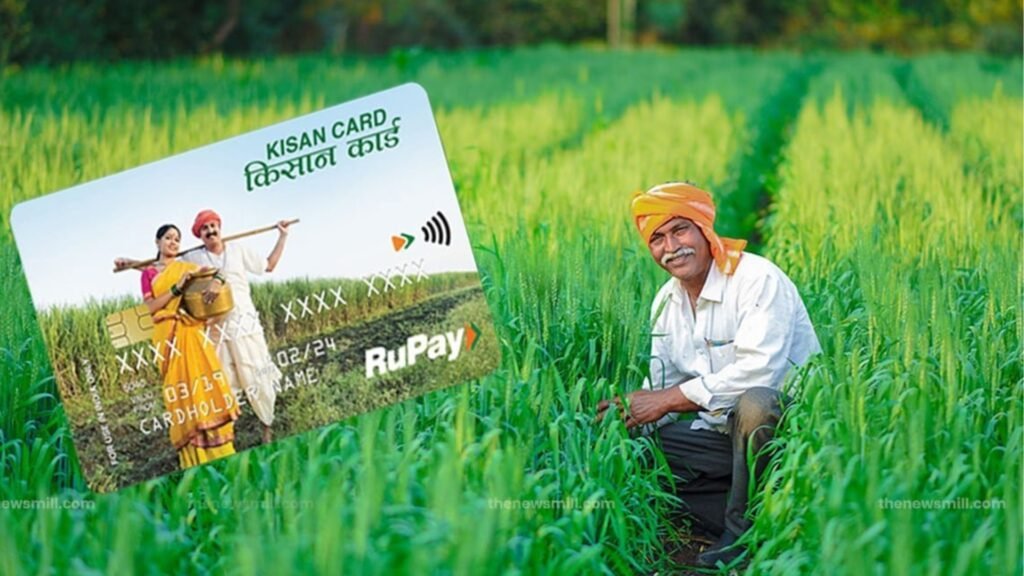

Kisan Credit Card (KCC)

What is a Farmers Credit Card? Why did the government bring this Kisan Credit Card scheme? What is the purpose behind it? How can every farmer get a farmer’s credit card? What are the benefits of using it? How to use it? What benefits will you get?

What is a Farmers Credit Card?

It is a credit card like different banks give, HDFC gives, ICC gives you, and State Bank of India gives you credit card, it is also a credit card but what is it? Created for, what is the purpose behind it? While harvesting the crop, the farmer needs various things for which he does not have immediate money, if you want to buy seeds, fertilizer, or medicine, you can use this farmer’s credit card anytime. You can and after some time you can return.

Paisa i.e. Kisan Credit Card will give you a short-term loan and that too with a very low interest rate, if you look at the beginning of this scheme it was started by the Reserve Bank and NABARD in 1988, under this scheme, if you are a farmer, any cooperative bank, public sector black or regional rural bank can give you this farmer credit card.

Documents required to apply

Kisan Credit Card is a power If you want to get the required documents then you will need Farmer’s Aadhaar Card, Farmer’s PAN Card, Farmer’s Bank Account Details, Farmer’s Land Documents, and Farmer’s Income Certificate from nearby Tehsil. . Also, if you want to avail this kisan credit card from a bank, you need a no-do certificate from the bank, i.e. you should not have any outstanding debt

How can farmers get a credit card?

Now the most important thing is how we can get a Kisan Credit Card. It’s very simple. You have to go to any nearby bank and ask the bank manager that I am a farmer, I want to get a farmer credit card. That officer and manager will tell you everything. What documents are required, what is the process, whatever is your record, i.e. cibil score, how much you are going to get based on your land, how to use it, for how many days you can use it. are, and will there be a refund amount and total amount to be paid, so no need to worry. It’s a simple matter. First collect all the information from the nearest bank, then give the documents.

How to Apply

If you have agricultural land, if you are a farmer, you must use a farmer credit card. If you official

If you want to collect information about it, there is a website www.pfkisaan.org.in. You can gather complete information about Kisan Credit Cards by visiting this website.

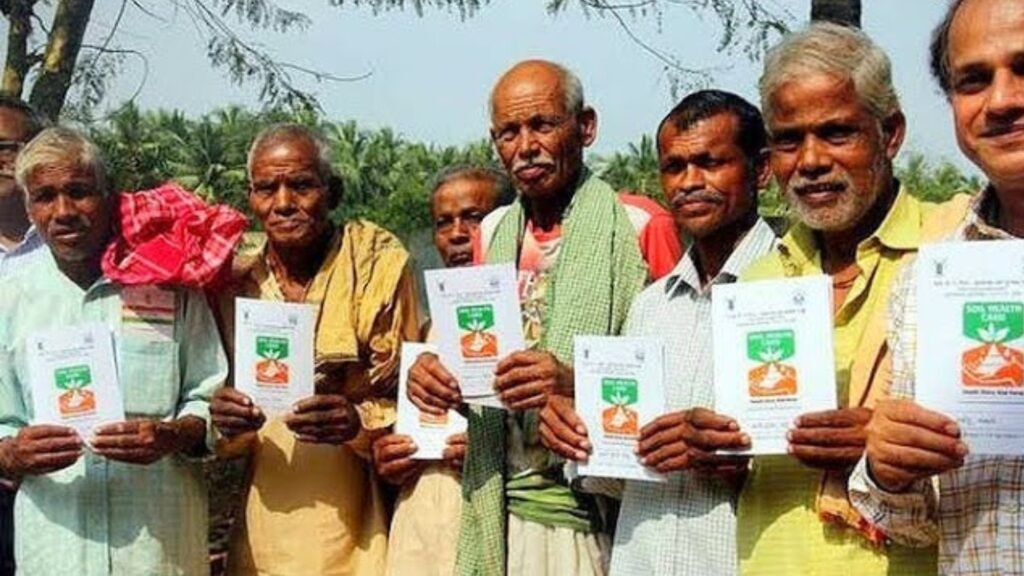

Soil Health Card Scheme

It was launched by the Government of India in 2015. It comes under the Department of Agriculture. In this scheme, the government plans to provide soil health to the farmers. sent to where experts call them sample score tests and witnesses to this appeal allow this friend to address the education of this new phenomenon which micronutrient deficiencies or all of this year in this file. There is a definition and along with this the experts have free suggestions on what nutrients or fertilizers are needed to meet this micro-deficiency and in what quantities. productivity can be increased. Under this scheme, the government has planned to issue soil cards to 3 crore farmers and along with this, a budget of Rs 568 crore has been allocated for this scheme. 2016 In the Union Budget of 2018, states were allocated Rs 100 crore for making soil cards and updating live scores. The main objective of this scheme was to improve the quality of the crops so that the productivity of the farmers would increase and the farmers would get more profit. Now this scheme is also being implemented so that more concrete testing can be done so that the farmers use balanced fertilizers and do not add more fertilizers to the crop so that they get more profit but also reduce their cost. Farms aware of this, Lucky Newton’s next goal was to provide soil and soil information to farmers and provide the city with crop rosters.

What is Soil Health Card?

What is Soil Health Card? A soil health card is a printed report that looks something like this. To collect the sample on it

Date, where collected, farm size, irrigation status, in which loop tested and concrete type, are all recorded. Along with this the new trend status of oil cut parasol is also mentioned. On the shoulder support chart, 12 different parameters are mentioned. These parameters are pet, electrical conductivity, organic carbon, nitrogen, phosphorus, potassium, sulphur, zinc and iron, manganese and copper, along with impurities, their test value, normal value and classification are mentioned to soil farmers in three categories. Is done intermittently. Soil samples are collected twice a year by cropping teams in rabi and kharif, after harvest there is no standing crop in the field, after which the method is divided into different sections on a suitable area. And olive oil samples are collected from these parts. Recruited by Agriculture Department staff or college students After the samples are collected, the samples are sent to the Agriculture Department where they are tested with standardized procedures.Next are the benefits of Soil Health Card. The card helps farmers to improve their crops, thereby increasing the productivity of their crops. I will be able to clarify, which will give them an input alternative, which will help them to improve their production. Crops in it

Intake of other micronutrients can also be increased.

This cream is famous for its left internship.

This will cause problems for your friends.

Instead of ignoring cotton and livestock every time, which require more input.

There are more drawbacks to the Soil Health Card scheme.

This is the drawback of the first scheme.

Dedicated uneducated pharmacists are not able to carry out this practice.

The drawback of the next scheme is that it focuses on the chemical properties of the soil.

Only salt type is given in the name of physical and biological properties.

The next issue is that some important indicators such as crop history, water bodies, microbial activity, world master retention history, such important indicators are not included in a small department.

There is lack of coordination between agriculture officers and farmers.

Finally, there is also the lack of infrastructure. A target was set to issue 800 Flax Oil Health Cards in the year 2015-16 but till July only Flax Oil Health Cards were distributed. The government had set a target of testing 14 million fruit samples, of which only fabric samples had been collected by 2016. Only 80 samples were collected, with only the tattoo black hole samples tested.

Employment and Skill Development Schemes

Pradhan Mantri Kaushal Vikas Yojana (PMKVY)

Pradhan Mantri Kaushal Vikas Yojana, so under this budget the Government of India has launched its fourth version to skill millions of youth, which will boost employment in our country. First know about its background, so Pradhan Mantri Kaushal Vikas Yojana, also known as PMKVY , is a flagship scheme of the Ministry of Skill. Development and Entrepreneurship, it is run by the National Skill Development Corporation, its first version was launched in 2015 with the objective of skill development in our country.How can it be promoted? By giving short term free skill training to people, by giving monetary rewards etc. to motivate them, by getting people skill certificates, all these were the objectives. Also, one of the main objectives was that any skill imparted in it should be industry related, that is, after learning that skill, people can go into that industry and earn a living for themselves.

After that, its second version was released from 2016 to 2020 and there is a third-party valuation in this regard, which believes that the monthly income of all the people taking training under this version, i.e. their monthly income after taking the training. earned 15% more than those who had not trained under it. Apart from this, the candidates also believe that the employment opportunities increase a lot after taking in-house training with it. The government has divided the entire scheme into parts. The first is short-term training.

The aim of the government is that 60 lakh youth will be trained here. The second is recognition of prior learning. To recognize whatever they have learned here, these candidates are given a short test through NSQF i.e. National Skill Qualification Framework. After that they are provided with a certificate with the help of which they can go and work in industries etc. The third component is special projects. So what does it do? Government enables a platform for these candidates where they can get training. Now these are in specific areas, in government institutions, in corporations etc. The fourth is the talent and employment fair. What does the government do about it? Every 6 months, it organizes a Rozgar and Kushal and Rozgar Mela to ensure that the scheme reaches more people. Then, there is the Placement Assistant in which the government provides the link between Pradhan Mantri Kaushal Vikas Yojana candidates and salary-paying employers. After that, there is continuous monitoring, which means monitoring of Pradhan Mantri Kaushal Vikas Yojana training centers etc. in the country. Then there is quality branding and communication where the government sees whether the scheme is successful on the ground. So, all these components are covered. Now we move towards the fourth phase of Pradhan Mantri Kaushal Vikas Yojana.

The phase which has been started now, so basically this phase will be implemented in the next three years and the focus of the scheme will be on job training and industry partnership and whatever training will be given will be in line with the current needs because Over time the needs of companies and industries grow or change, the requirements also change over time, so for example now if coding is required then all these things will be taught here, whether coding Be it artificial intelligence, be it robotics, be it mechatronics. Internet of things, 3D printing, drones, other soft skills including spoken English etc will be taught here, after that

The government has also decided to open around 30 Skill India International Centers in various states. What will it do? This will basically give an opportunity to the youth of our country to go abroad and earn. Also, it will encourage the youth of our country that if they are starting a business, they should grow it in such a way that they are not just takers, but also givers of jobs. Apart from this, the government will also launch the Unified Skill India Digital Platform here and what will this platform ba sically do? This platform will enable formal scaling based on demand. In this platform, basically there will be employers etc., givers, companies etc., they will be connected and they can pick up any candidate from here as per their requirement.

Mahatma Gandhi National Rural Employment

The guarantee scheme is a game changer. Initiatives aimed at increasing livelihoods. We will do security in rural areas first. will expose his goals. Identify the responsible authority. We will know after its implementation. who benefit from the scheme and finally we will explore its other important features. The scheme aims to provide at least 100 days to reach its primary target. Wage employment guaranteed in financial to every rural household whose year. Adult members volunteer to do unskilled work. Apart from this, manual work is also its aim. The implementation of the Ministry of Rural Development is responsible for the creation of sustainable assets related to the scheme in collaboration with the State to oversee the entire implementation of the scheme.

INDEX AGRICULTURAL LABOR

Panchayat and lastly the project scheme helps in skill development. Beneficiaries so that they can move from the existing part-time full-time employment scheme stands. As a pillar of rural development and by addressing social security in India, it continues to transform the lives of millions of livelihoods in protection and promotion of sustainable development

Education and Child Development Schemes

Midday Meal Scheme:PM PENSION YOJANA

The mid-day meal scheme is a school meal. The Government of India program is designed to improve nutrition. The program is provided free of charge to state school-going children across the country. Lunch on weekdays for children. Primary and Upper Primary classes in Government Government assisted local bodies Education Guarantee Scheme An Alternative Modern Education Centers Medusa and Maktab supported Abhiyan and National Child Labor Project Schools managed by the Ministry of Labor

Serving more than 120 million children, there are 265,000 schools and centers under the Education Guarantee Scheme.

The largest such program in the world is under Article 24 Paragraph 2C of the Convention on the Rights of the Child to which India is a party. Committed to adequate supply. Nutritious foods for children The program has undergone many changes since then. It started with Mid-Day Mail in 1995. The scheme is covered by national food. The legislative backing of the Security Act of 2013 is the Indian School Meals Program. Similar to the legal backing provided in the US National School Lunch Act.