PMEGP Loan Scheme 2024 If you additionally favor to begin your personal commercial enterprise and you do now not have that a lot money, then this scheme is going to be very really helpful for you, if you choose to take gain of this scheme, then study this put up until the end, you will get all the statistics in this submit like what is going to be the eligibility for this scheme and how can you take benefit of it and what essential files are required in it. In today’s time. Everyone desires to begin their personal business. But due to lack of money, they are no longer capable of beginning their personal business. Keeping this in mind, a new scheme used to be launched thru the central government. Whose title is PMEGP Loan Scheme. Through this scheme, all the humans will be given loans for business. Also a subsidy will be given on this loan.

PMEGP Loan Scheme Overview

This PMEGP loan has been run via the Pradhan Mantri Rojgar Srijan Program, to follow for PMEGP, you have been given a shape on its reputable website, what are the matters to hold in idea whilst filling this form, how a great deal mortgage is available, how a great deal subsidy is available? And do you want any kind of loan? To get all this information, you have to examine this publish completely, however friends, earlier than that it is very essential for you to have all the statistics about this loan, how an awful lot mortgage you get thru this PMEGP Scheme, you can see it here, 50,00,000 for manufacturing unit and 20,00,000 for carrier unit and this is the most amount. If you choose to do any manufacturing work, then you can get a provider mortgage of 50,00,000 here. You will get it without problems underneath this scheme.

You Can Also Read : Jharkhand Bijli Bill Mafi Yojana

What are the Main PMEGP Details?

• Banks sanction funding up to 95% of the undertaking cost.

• On this, the authorities present 15% to 30% as margin cash or PMEGP subsidy.

• The financial institution affords the final 60% to 75% as a Term Loan and working capital in the shape of money credit score or in the structure of a composite mortgage consisting of capital expenditure and working capital.

• Interest prices are regular, from 11% to 12%.

• Repayment tenure is three to 7 years after a preliminary moratorium.

Eligibility for PMEGP Loan 2024

• To avail the advantages of PMEGP scheme, the age of the applicant must be extra than 18 years.

• To follow in this scheme, the instructional qualification of the applicant must be at least eighth type pass.

• There are no profits restricted to avail the advantages of this scheme.

• Societies registered below 1860, self-help groups, charitable trusts, societies, manufacturing cooperative societies, enterprise proprietors and entrepreneurs can take PMEGP loans.

• Businesses which are getting the advantage of subsidy via any different scheme will now not get the advantage of this scheme.

You Can Also Read : Joy Bangla Pension Scheme

Documents Required for PMEGP Loan Scheme 2024

- Aadhar Card

- PAN Card

- Application Form

- Residence Certificate

- 8th Pass Certificate

- Project Report

- Other Documents Required by using Bank or Loan Institute

- Certificate of Entrepreneur Development Program Training

- Mobile Number and Email ID

- Passport Size Photograph

| Loan Amount | 9.5 to 50 Lakh |

| Interest Rate | Vary from lender to lender |

| Age | Minimum 18 years or greater |

| Subsidy Project | 15%-35% |

| Maximum Project Cost | ₹20 Lakh for carrier and ₹50 lakh for manufacturing units |

| PMEGP Loan Limit | 5-10% for carrier and 5-10% manufacturing units |

| Beneficiary Contribution | 5-10% for carrier and 5-10% manufacturing units |

| Bank Sanctioned | 90-95% for carrier and 90-95% manufacturing units |

| Bank Credit Coverage | 15-30% for carrier and 15-30% manufacturing units |

| PMEGP Scheme Coverage | 15-30% for carrier and 15-30% manufacturing units |

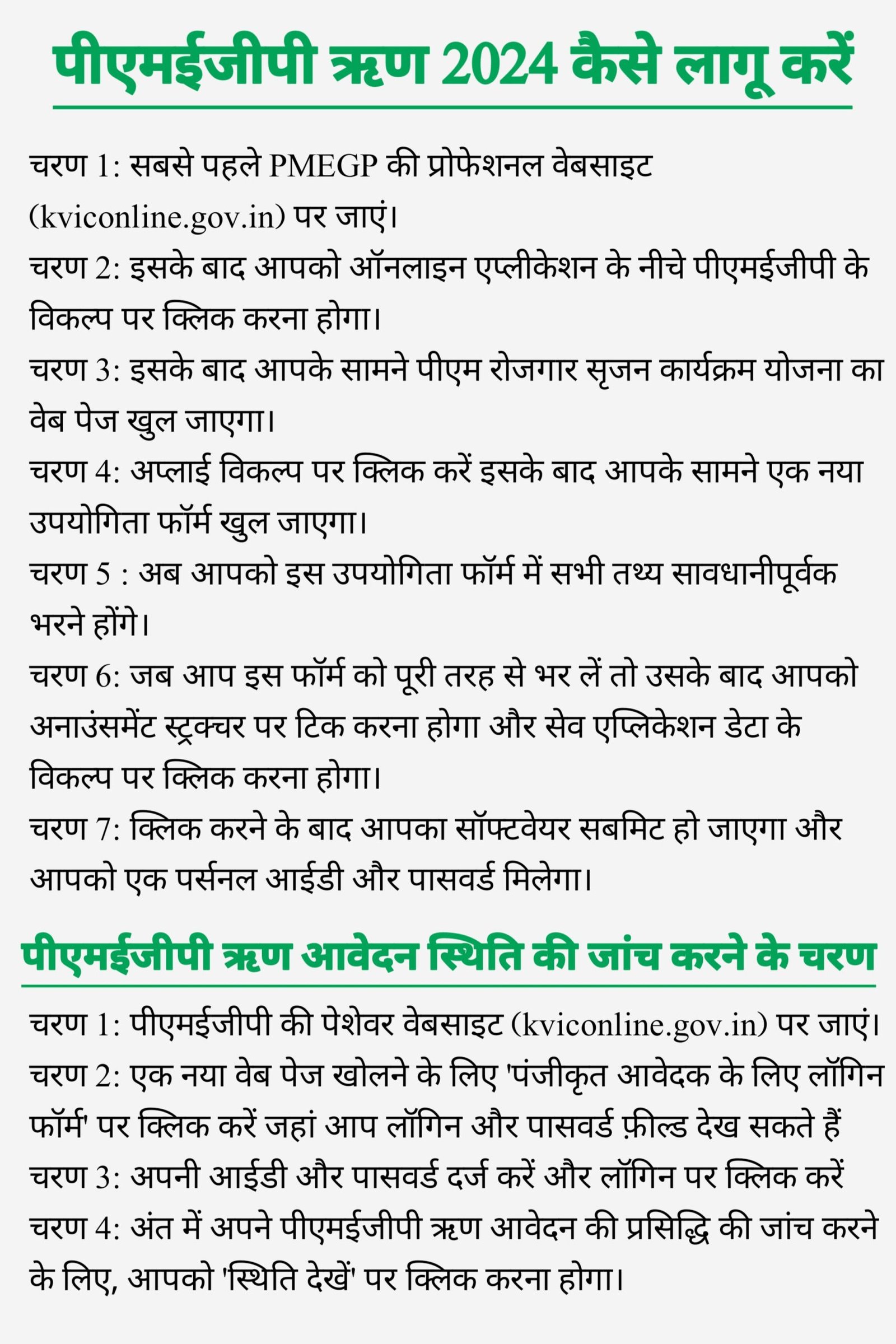

How to Apply PMEGP Loan 2024

STEP 1 : First visit the professional website of PMEGP (kviconline.gov.in).

STEP 2 : After this, you have to click on the alternative of PMEGP below Online Application.

STEP 3 : After this, the web page of the PM Employment Generation Program Scheme will open in front of you.

STEP 4 : Click on Apply option after that a new utility form will open in front of you.

STEP 5 : Now you have to fill all the facts cautiously in this utility form.

STEP 6 : When you fill this shape completely, after that you have to tick on the announcement structure and click on the choice of Save Application Data.

STEP 7 : After clicking, your software will be submitted and you will get a personal ID and password.

You Can Also Read : Gruhalakshmi Mahiti Kanaja Scheme

Steps to Check PMEGP Loan Scheme Application Status

STEP 1: Visit the professional website of PMEGP (kviconline.gov.in).

STEP 2: Click on ‘Login Form for Registered Applicant’ to open a new web page the place you can see login and password fields

STEP 3: Enter your ID and Password and click on on Login

STEP 4: Finally to test the fame of your PMEGP mortgage application, you want to click on on ‘View Status’

You Can Also Read : PM E-Drive Scheme

Subsidy Under PMEGP Loan Scheme

Through the Pradhan Mantri Employment Generation Scheme (PMEGP), the authorities offer subsidies to the beneficiary applicants, this subsidy is 35% in rural areas and 25% for city areas. Loans are supplied through this scheme with very few formalities. The applicant businessman can follow for a mortgage of Rs two lakh to Rs 10 lakh underneath this loan.

You Can Also Read : Digital India Internship Scheme

FAQs

What is the PMEGP Full Form?

What is the most venture value allowed below PMEGP?

What is the PMEGP mortgage hobby rate?

Still have more questions About PMEGP Loan Scheme 2024?

If you have any further questions, we are here to serve you. Join the WhatsApp channel by clicking on the button below. Visit our website on daily basis. Our website hindiyojananews.net provides complete details of all the schemes launched by the Indian Government. You can find complete details about all these schemes released by the Indian government on our website Our Website Not A Official Site. We Provide Just Latest News Update About Social Schemes !