The Kerala Saranya Loan Scheme has rolled out various initiatives to support and empower women throughout the state.. One of the latest initiatives is the Saranya Loan Scheme, designed specifically for destitute women seeking self-employment opportunities. In this article, we will cover everything you need to know about the Saranya Loan Scheme, including details on the application form, eligibility criteria, benefits, and the loan amount. By the end of this article, you’ll have a clear understanding of how the scheme works and how it can help you.

Also Read: Orunodoi Assam Apply

Kerala Saranya Loan Scheme 2024

The Kerala Government has introduced the Saranya Scheme to support the most marginalized women in the state, including widows, divorced women, deserted women, spinsters over 30, and unwed mothers from Scheduled Tribes, as well as differently-abled women and wives of bedridden patients.

Through the Kerala Saranya Loan Scheme, eligible women can receive an interest-free loan of up to ₹50,000 to start their own self-employment ventures. Of this amount, 50% (up to a maximum of ₹25,000) is provided as a government subsidy through the Employment Department. The loan repayment is structured in 60 equal monthly installments.

Benefits & Features of the Saranya Loan Scheme

- Target Audience: This scheme aims to support the most marginalized women in Kerala, such as widows, divorced women, deserted women, spinsters over 30, unwed mothers from Scheduled Tribes, differently-abled women, and wives of bedridden patients.

- Loan Amount: Women who qualify can get loans of up to ₹50,000 to start their own self-employment ventures.

- Government Subsidy: The government provides a subsidy of 50% of the loan amount, up to a maximum of ₹25,000.

- No Security Required: There is no need for beneficiaries to provide any security for the loan.

- Additional Loan Conditions: If the loan amount exceeds ₹50,000, the applicant must contribute 10% of the excess. A flat interest rate of 3% is charged on any amount borrowed beyond ₹50,000.

- Individual and Joint Ventures: The scheme allows for both individual and joint ventures, with each participant in a joint venture eligible for the maximum loan and subsidy.

- Expansion Opportunities: For ventures that have successfully repaid at least 50% of the loan, there is an option to apply for an additional loan of up to 80% of the original amount at nominal interest rates to expand the business

Also Read: Government Schemes List

Monitoring of the Saranya Loan Scheme

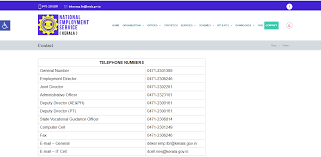

The Saranya Loan Scheme is overseen by District Employment Officers and Employment Officers at Town Employment Exchanges. The Director of Employment Exchange acts as the main overseer for the scheme.

If a beneficiary fails to repay three consecutive installments, they will receive two reminders. If there is still no response, action will be taken to recover the loan amount with interest.

If it is discovered that the loan was used for purposes other than intended, the full amount, including the subsidy, will be recovered through revenue recovery methods.

Also Read: PM Kusum Yojana Price List

Key Highlights

| Key Highlight | Details |

|---|---|

| Scheme Name | Saranya Loan Scheme |

| State | Kerala |

| Launched By | Employment Department |

| Category | Self-Employment Support |

| Target Beneficiary | Women in Kerala |

| Benefit | Financial assistance for self-employment |

| Application Mode | Offline |

| Application Form | Available Here |

Saranya Loan Scheme Eligibility Criteria

Eligibility:

- Unemployed widows, divorced women, deserted women, and spinsters over the age of 30.

- Unwed mothers from Scheduled Tribes (STs) who are registered with the Employment Exchange and are between 18 to 55 years old.

Income Limit: The annual family income should not exceed ₹1 lakh.

Preference: Preference will be given to individuals with professional or technical qualifications.

Registration Requirement: If you are not registered with the Employment Exchange, click here to register

Saranya Loan Scheme Required Documents

- Visit the Official Website: Go to the official website of the Saranya Self Employment Scheme.

- Download the Application Form: Click on the link to download the application form.

- Complete the form by filling in your details, such as your name, address, and mobile number.

- Enter Employment Exchange Registration Number: Provide your Employment Exchange Registration Number and other relevant information.

- Submit the Form: Submit the completed form to the nearest Employment Exchange Office.

- Verification Process: The Employment Exchange will verify the information provided in your application and check all certificates.

- Loan Disbursement: After verification, the loan amount will be transferred directly to your bank account by the Employment Department.

Also Read: Odisha Farmer ID List

Procedure To Apply Under Kerala Aswasakiranam Scheme

- Visit the Nearest Office: Go to the nearest Anganwadi or ICDS office.

- Obtain the Application Form: Collect the application form from the office.

- Complete the Form: Fill out the application form with all required details.

- Upload Documents: Attach and upload all necessary documents.

- Submit the Form: Submit the completed form to the nearest Anganwadi Centre or ICDS office.

By following these steps, you can apply for the Kerala Aswasakiranam Scheme.

Coverage Of Diseases Under Kerala Aswasakiranam Scheme

- Bedridden Patients: Individuals who require a full-time caregiver.

- Mentally Challenged: Includes conditions such as autism, cerebral palsy, mental retardation, and mental illness.

- Severe Visual Impairment: 100% blind individuals who are also bedridden.

- Cancer Patients: Bedridden patients undergoing cancer treatment.

- Old Age Bedridden: Elderly individuals who are bedridden.

- Brittle Bone Disease: Individuals suffering from brittle bone disease.

Self-employment initiative designed specifically for destitute women

The Saranya Scheme is a self-employment initiative designed specifically for destitute women in Kerala. Launched by the Kerala State Government, the scheme provides financial assistance to help women start their own businesses. The primary aim is to empower marginalized women by offering them interest-free loans up to ₹50,000, along with subsidies, to support their entrepreneurial ventures. This program is particularly targeted at widows, unmarried mothers, and other disadvantaged women who lack financial stability.

Would you like a more detailed rewrite or further details?

Also Read: West Bengal Widow Pension Scheme

FAQ Kerala Saranya Loan Scheme

What is the Kerala Aswasakiranam Scheme?

Who is eligible for the scheme?

What documents are required for the application?

Still have more questions About Kerala Saranya Loan Scheme ?

If you have any further questions, we are here to serve you. Join the WhatsApp channel by clicking on the button below. Visit our website on daily basis. Our website hindiyojananews.net provides complete details of all the schemes launched by the Indian Government. You can find complete details about all these schemes released by the Indian government on our website Our Website Not A Official Site. We Provide Just Latest News Update About Social Schemes !

Here Are ALL Government Popular Schemes Name

Agriculture Schemes

Pradhan Mantri Kisan Samman Nidhi (PM-KISAN)

Soil Health Card Scheme

Pradhan Mantri Fasal Bima Yojana

Education Schemes

Pradhan Mantri Jan Dhan Yojana

Beti Bachao Beti Padhao

Sarva Shiksha Abhiyan

Healthcare Scheme

Ayushman Bharat

Pradhan Mantri Matru Vandana Yojana

National Health Mission

Housing Schemes

Pradhan Mantri Awas Yojana (PMAY)………….!