The Government of India can launch a mudra loan scheme to provide small and easy loans for the small businessmen. These businessmen belong to the non cooperative and non farm sector. Small businessmen and entrepreneurs can get loans up to 10 lakh to start up their business and grow. This is the great chance for the entrepreneurs to start up their business. All the applicants who want to apply for this Yojana if they meet the all eligibility criteria they visit the official website and fill out the application form to become a part of this Yojana.

Revised Mudra Loan Scheme 2.0

When the budget of 2024 and 2025 is released by the finance minister the finance minister of India can launch the Mudra loan scheme to provide loans to the small and micro entrepreneurship award to start up their business. Mudra loan scheme was an improved version and in this Yojana you can receive 10 lakh extra loan. Now you can receive 20 lakh loan from Mudra loan came 2.0 to start up your business and this is helpful for the small entrepreneurship and micro businessman. If you were selected under this Yojana you can get a 20 lakh loan to start up your business and grow them.

Objective Of Mudra Loan Scheme 2.0

- Main objective is to help the small or micro entrepreneurship

- Then they grow their business and from new jobs for those people who do not work

- The Government of India setup 5.4 Crore lakh loans for selected applicants

- It encourage the small or micro businessmen to grow their business

- There are three types of loan for small and micro businessman

- Type help in a different ways by giving loan

Eligibility Criteria

Applicant must be:-

- Shopkeepers

- Fruit and Vegetable vendors

- Artisans

- Truck operators

- Food service units

- Repair shop

- Small manufacturing Enterprise

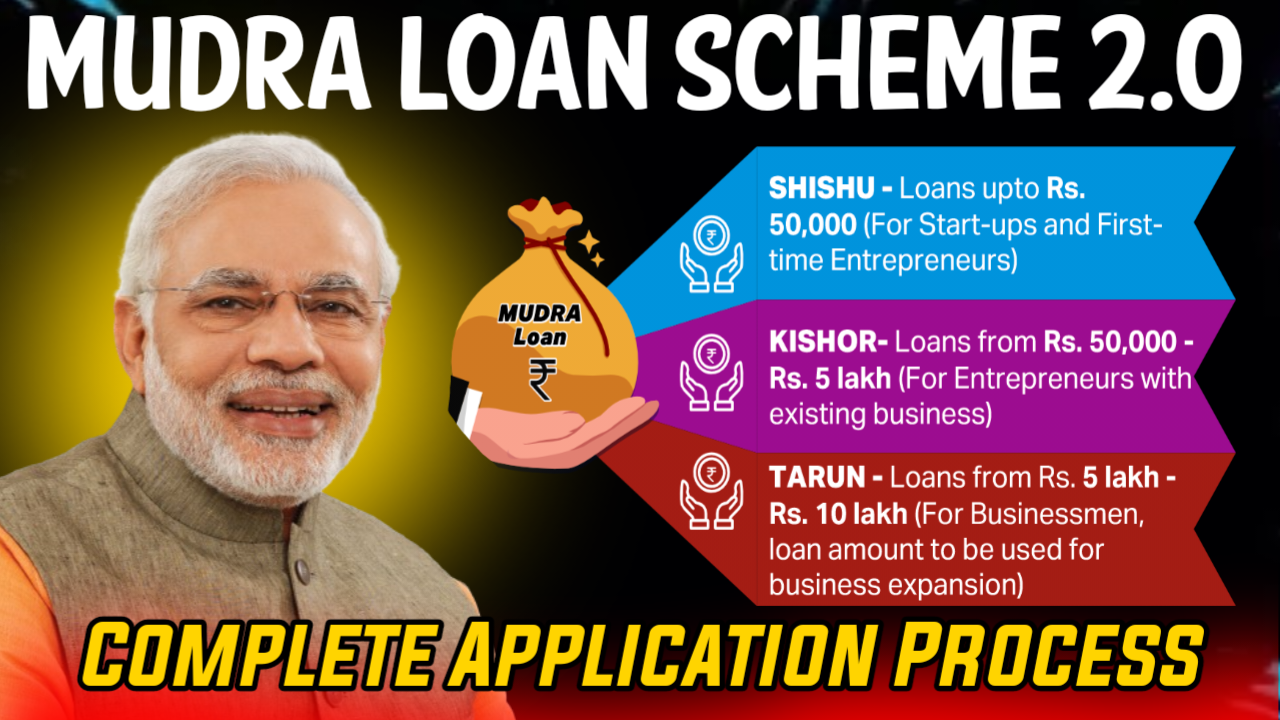

Types of Mudra Loans

There are three types of Mudra loans given below

- The shishu category give loan up to 50000

- Kishor category give loan up to 50000 to 5 lakh

- Tarun category give loan up to 5 lakh to 20 lacs

Required Documents

- Aadhar Card

- Ration card

- Mobile Number

- Electricity bill

- Address Proof

- PAN Card

Apply Online For Mudra Loan Scheme 2.0

Step 1: all the applicant who complete the all eligibility criteria can visit the official website and when there is the official website they click on udyamita portal

Step 2: after they click on apply now and you registration from will be appear hear the applicant filler all details like mobile number and click on generate OTP

Step 3: After that the applicant fills all details and also feels OTP and clicks on submit.

Step 4: registration form will be appear and applicant feel all the details that asked attached all necessary documents

Step 5: after that a quickly review you are all details and click on submit to complete process

Apply Offline For Mudra Loan Scheme 2.0

Step 1: first of all applicant visit the commercial bank to apply for this Yojana

Step 2: when a day reach the commercial bank simply download the farm on category that they want to get loan

Step 3: after selecting category they simply download the farm and print out it after that a day feel the all details on application form and attach all necessary documents that asked

Step 4: after that you simply review all details and click on submit to complete process

Contact Details

- help@mudra.org.in

FAQs

Which loan scheme was launched by the government of India?

What are the benefits of this Yojana?

Who applied for this Yojana?