Paytm Personal Loan 2024 Eligibility, Interest Rates Most humans should use the Paytm cell app for digital transactions. Through which cell recharge, invoice payment, and online transactions are all done. But this Paytm cellular app is additionally giving you a non-public mortgage of up to ₹3 lakh for your private needs, that too at easy pastime rates. If you are between the age of 25 to 60 years, and choose to take a private mortgage for yourself, then you can follow it. Paytm cellular app is the most preferred fee app in the country. A few years ago, Paytm used to be given the fame of a price bank. Because of this, Paytm gives enterprise loans, private loans, etc. to its users. Through Personal Loan, any man or woman can get a non-public mortgage of up to ₹3 lakh in two minutes, whose compensation duration will additionally be forty eight months.

You Can Also Read : Mahamesh Yojana Benefits Eligibility Application Process

Paytm Personal Loan Calculator

The Personal Loan EMI calculator online device helps debtors estimate their month-to-month repayments. A private mortgage calculator is really useful when computing EMIs. The Personal Loan EMI Calculator requires you to fill in solely three imperative fields to decide your month-to-month installments – the mortgage quantity you want to borrow, accompanied through the hobby price and the tenure.

You can change your EMI payments to meet your eligibility and this will reduce your monthly debt and you can easily do this with an EMI calculator.

EMI for a two lakh Personal Loan

- The EMI relies upon the activity fee and tenure. You can use a Rs. two lakh non-public mortgage EMI calculator to discover the EMI.

- EMI for a Rs two lakh non-public mortgage at 11% p.a. for 5 years is Rs. 4,348.

For More Info : Huda Plot Scheme

EMI for a three lakh Personal Loan

- If you avail a mortgage of Rs.3 lakh for a tenure of 1 year the place the fee of hobby charge charged is 10%, then the EMI payable will be Rs.26,375.

Paytm Personal Loan Interest Rates

Although these hobby fees rely on the applicant’s profile, his CIBIL score, and different details. But typically Paytm charges hobby prices ranging from 8% to 16%. Whereas if you take a private mortgage for solely one month, then the pastime charge for you will be 0%.

| Name | Paytm Personal Loan 2024 |

| Lender | Paytm Payment Bank |

| Objective | To grant small non-public loans for the private desires of individuals. |

| Beneficiary | All residents of India |

| Apply | Online |

| Year | 2024 |

| Official Website | paytm.com |

Eligibility of Paytm Personal Loan 2024

- The man or woman receiving the mortgage should be an Indian citizen.

- The age of the applicant ought to be between 25 to 60 years.

- The applicant must be a lively person of Paytm cellular app.

- The applicant needs to have executed most transactions via Paytm.

- It is very important that the applicant’s CIBIL is correct, it will make it easier for him to get a loan and he will not face any problem.

- There have to no longer have been any mortgage default in the past.

- Both self-employed and salaried people will be eligible for Paytm nonpublic loan.

- The minimal month-to-month earnings need to be greater than ₹12,000.

You Can Also Read : Kalia Yojana Next Installment Date

Documents Required for Personal Loan 2024

- Aadhaar Card

- PAN Card

- Any report of enterprise or job

- Latest profits slip

- Bank statement

- Mobile range linked to Aadhaar

- Passport measurement photo

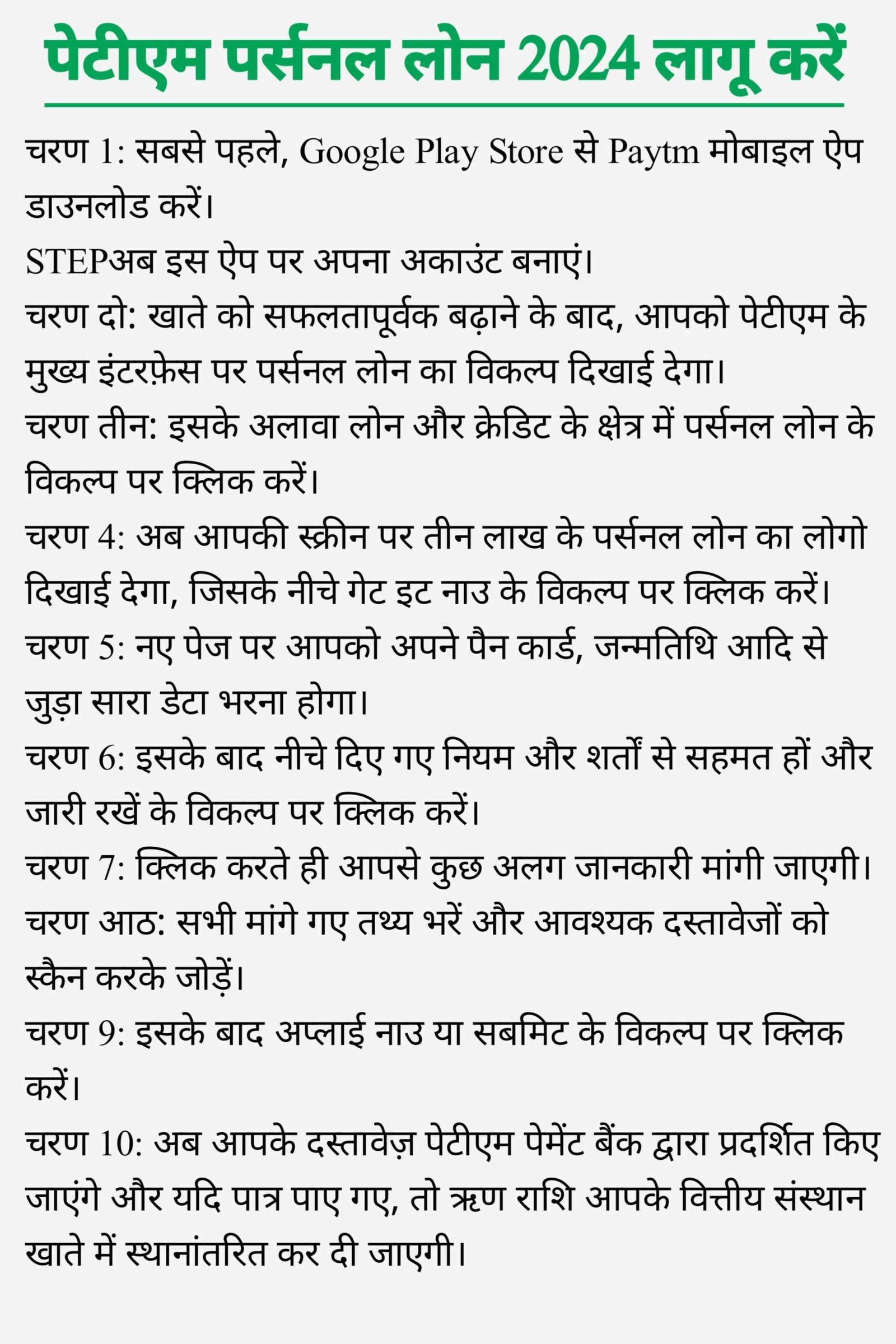

How to Apply Paytm Personal Loan 2024

STEP 1 : First of all, download the Paytm Mobile App from Google Play Store.

STEP 2 : Now create your account on this app.

STEP 3 : After efficiently growing the account, you will see the choice of Personal Loan on the major interface of Paytm.

STEP 4 : Apart from this, click on the choice of Personal Loan in the area of Loan and Credit.

STEP 5 : Now the emblem of a private loan of three lakhs will show up on your screen, beneath which click on the choice of Get it Now.

STEP 6 : On the new page, you will have to fill in all the data associated with your PAN card, date of birth, etc.

STEP 7 : After this, agree to the Term and Conditions under and click on the choice of Continue.

STEP 8 : As quickly as you click, you will be requested for some different details.

STEP 9 : Fill all the requested facts and scan and add the required documents.

STEP 10 : After this, click on the alternative of Apply Now or Submit.

STEP 11 : Now your archives will be demonstrated via Paytm Payment Bank and if observed eligible, the mortgage amount will be transferred to your financial institution account.

For More Info : Assam Job Card

FAQs

How a great deal pastime will be charged?

Where will Paytm switch my mortgage amount?

How can I apply?

Still have more questions About Paytm Personal Loan 2024?

If you have any further questions, we are here to serve you. Join the WhatsApp channel by clicking on the button below. Visit our website on daily basis. Our website hindiyojananews.net provides complete details of all the schemes launched by the Indian Government. You can find complete details about all these schemes released by the Indian government on our website Our Website Not A Official Site. We Provide Just Latest News Update About Social Schemes !