For the welfare and development of ladies entrepreneurs in India, the authorities launched the Udyogini Scheme for Women Entrepreneurs 2024. The Udyogini Scheme has been carried out through the Women Development Corporation of the Government of India. This application affords monetary help to females to motivate and encourage them to begin and run their organizations amongst the underprivileged. The Udyogini Scheme for Women Entrepreneurs 2024 will advantage persons and households by means of growing their earnings and promoting countrywide development. Interested women residents of India can observe the scheme and acquire the advantages of this scheme.

You Can Also Read : UP Shadi Anudan Yojana

The Objectives of the Udyogini Scheme for Women Entrepreneurs

The predominant goal of this Udyogini Scheme for Women Entrepreneurs is to help girls in turning into self-sufficient with the aid of launching their businesses. It intends to provide skill-development guides in addition to monetary assistance. Without any discrimination and injustice, interest-free loans will be given to ladies for any enterprise venture. In addition to offering monetary support, the major goal of this software is to sketch and put in force ability improvement coaching packages for women.

Udyogini Scheme from Karnataka State Women’s improvement Corporation (KSWDC)

• Encouraging ladies to take out loans from banks and different monetary establishments to habits KSWDC-listed income-generating things to do or different worthwhile things to do for which KSWDC assists in the structure of grants.

• For girls belonging to scheduled caste and scheduled tribe unit price is Rs. 1 lakh to most of Rs. 3 lakhs. Subsidy is 50% of the mortgage amount, the earnings restriction of the household has to be under Rs. 2 lakhs.

• For females belonging to exceptional category, widowed or time-honored category, the most unit fee is Rs. 1 lakh. Subsidy for different class girls is 30% or a maximum of Rs. 10,000/- and subsidy for the familiar class is 20% or a maximum of Rs. 7,500/-.

For More Info : PM Kisan 18th Installment New Registration

| Name | Udyogini Scheme for Women Entrepreneurs |

| Launched by | Government of India |

| Implemented by | Government of India’s Women Development |

| Interest Rate | Competitive, subsidized, or free for one-of-a-kind cases |

| Annual Family Income | Rs. 1.5 lakh or less |

| Loan Amount | Max. up to Rs. 3 lakhs |

Eligibility Criteria

- Only woman entrepreneurs are eligible for enterprise loans.

- Not having neglected any repayments on a preceding mortgage from a monetary institution.

- A candidate who can repay their money owed and has a suitable deposit score.

List of Businesses in Udyogini Scheme

- Agarbatti Manufacturing

- Audio & Video Cassette Parlour

- Bakeries

- Banana Tender Leaf

- Bangles

- Beauty Parlour

- Bedsheet & Towel Manufacturing

- Book Binding And Note Books Manufacturing

- Bottle Cap Manufacturing

- Cane & Bamboo Articles Manufacturing

- Canteen & Catering

- Chalk Crayon Manufacturing

- Chappal Manufacturing

- Cleaning Powder

- Clinic

- Coffee & Tea Powder

- Condiments

- Corrugated Box Manufacturing

- Cotton Thread Manufacturing

- Crèche

- Cut Piece Cloth Trade

- Dairy & Poultry Related Trade

- Diagnostic Lab

- Dry Cleaning

- Dry Fish Trade

- Eat-Outs

- Edible Oil Shop

- Energy Food

- Fair-Price Shop

- Fax Paper Manufacturing

- Fish Stalls

- Flour Mills

- Flower Shops

- Footwear Manufacturing

- Fuel Wood

- Gift Articles

- Gym Centre

- Handicrafts Manufacturing

- Household Articles Retail

- Ice Cream Parlour

- Ink Manufacture

- Jam, Jelly & Pickles Manufacturing

- Job Typing & Photocopying Service

- Jute Carpet Manufacturing

- Leaf Cups Manufacturing

- Library

- Mat Weaving

- Match Box Manufacturing

- Milk Booth

- Mutton Stalls

- Newspaper, Weekly & Monthly Magazine Vending

- Nylon Button Manufacturing

- Old Paper Marts

- Pan & Cigarette Shop

- Pan Leaf or Chewing Leaf Shop

- Papad Making

- Phenyl & Naphthalene Ball Manufacturing

- Photo Studio

- Plastic Articles Trade

- Pottery

- Printing & Dyeing of Clothes

- Quilt & Bed Manufacturing

- Radio & TV Servicing Stations

- Ragi Powder Shop

- Readymade Garments Trade

- Real Estate Agency

- Ribbon Making

- Sari & Embroidery Works

- Security Service

- Shikakai Powder Manufacturing

- Shops & Establishments

- Silk Thread Manufacturing

- Silk Weaving

- Silk Worm Rearing

- Soap Oil, Soap Powder & Detergent Cake Manufacturing

- Stationery Shop

- STD Booths

- Sweets Shop

- Tailoring

- Tea Stall

- Tender Coconut

- Travel Agency

- Tutorials

- Typing Institute

- Vegetable & Fruit Vending

- Vermicelli Manufacturing

- Wet Grinding

- Woolen Garments Manufacturing

You Can Also Read : Majhi Ladki Bahin Yojana 3rd List

Required Documents

- passport-size photos

- Applicant must have birth certificate and credit card

- Completed Application Form with Proof of Address and Income; Application for Below Poverty Line (BPL) Card; Ration Card; and, if applicable, Caste Certificate

- Bank passbook copy, along with account details, financial institution and department names, holder name, IFSC, and MICR

- Any different forms that the financial institution or NBFC requires

Bajaj Finserv Business Loan in Udyogini Scheme

| Interest Rate | Interest-free Loan to ladies from all sections of the society |

| Loan Amount | Max. up to Rs. 3 lakhs |

| Loans Available for | 88 SSIs – Small Scale Industries |

| Subsidy | Up to 30% |

| Family Income Criteria | Should be much less than Rs. 1.5 lakh |

| Training for Skill Development | Available |

Business Loans provided by Punjab & Sind Bank Under Udyogini Scheme

| Interest Rate | Vyapar Loan As per price relevant to MSME |

| Types of the loan | Provision of loans through loan working capital |

| Loan Amount | Loan/limit shall range from case-to-case foundation and upon the reason of loan |

| Processing Fee | Nil |

| Margin | Nil up to Rs. 25,000 |

| Security/Collateral | Nil, up to Rs. 25,000 Above Rs. 25,000: Pledge of/Hypo. of property created out of financial institution mortgage Guarantee of partner or 1/3 birthday party Collateral protection in the shape of land/building property at least doubles the cost of mortgage (including the cost of belongings in case of time period loan) |

How can the Udyogini Scheme be beneficial for Women Entrepreneurs?

• Encouraging ladies who favor beginning incomes cash to follow for loans from banks and different lenders.

• Offering interest-free loans to certified female beneficiaries barring any discrimination or bias.

• Women who belong to one-of-a-kind classes such as SC/ST need to have a simpler right of entry to economic aid.

• Prevent lady debtors from personal lenders or different economic establishments from taking out high-interest loans.

• Assure the woman beneficiaries of EDP Training get hold of talent enhancements.

You Can Also Read : Mukhyamantri Vayoshri Yojana

How to Apply for the Udyogini Scheme?

When it comes to making use of the Udyogini Scheme, candidates can use online and offline mediums.

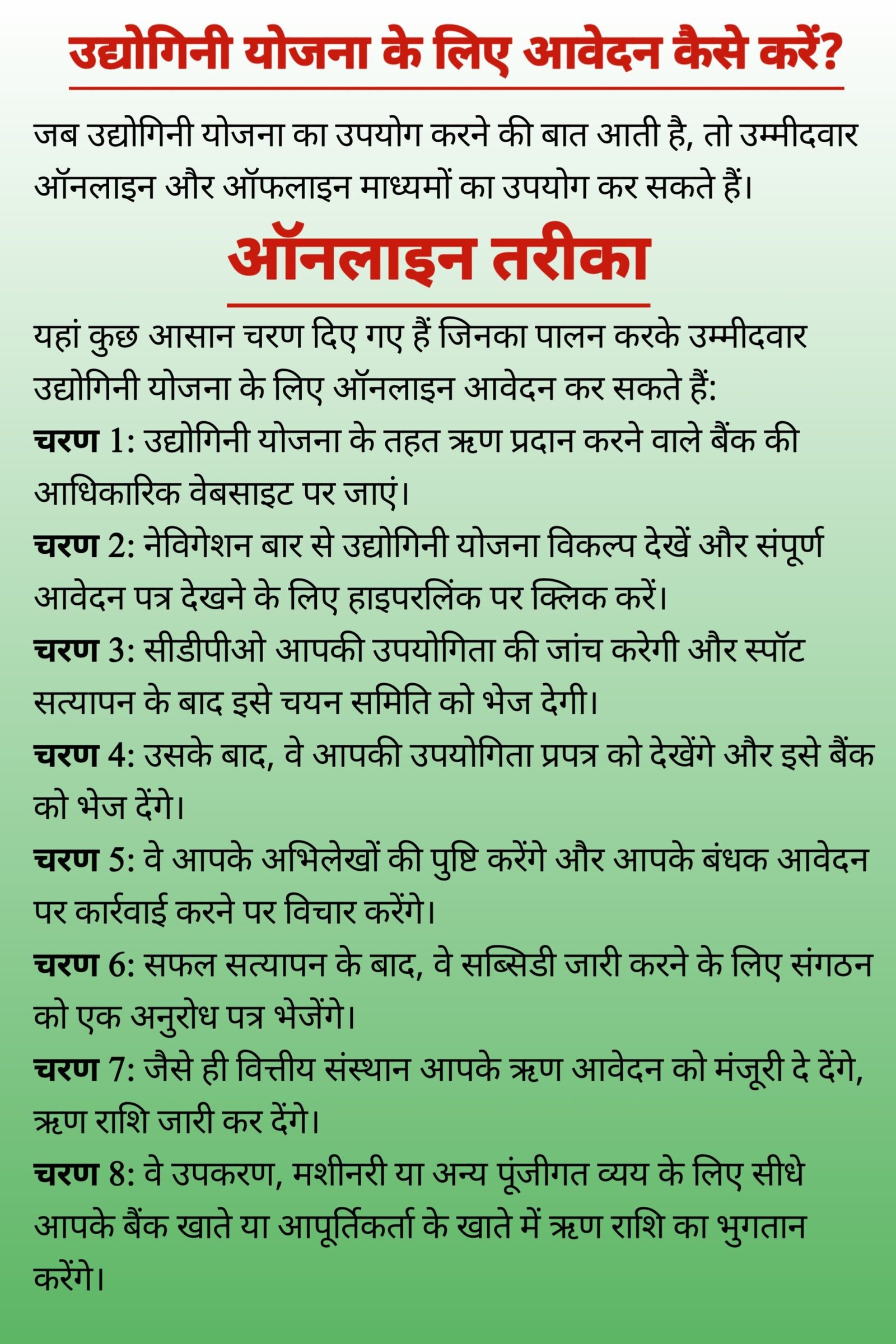

Online Method

Here are a few easy steps candidates can observe to apply for the Udyogini scheme online:

Step 1: Visit the official website of the bank providing loans under the Udyogini scheme.

Step 2: Look for the Udyogini scheme choice from the navigation bar and click on the hyperlink to see the whole utility form.

Step 3: CDPO will scrutinize your utility and forward it to the choice committee after spot verification.

Step 4: After that, they will look at your utility shape and forward it to the bank.

Step 5: They will confirm your archives and undertake thought to procedure your mortgage application.

Step 6: After profitable verification, they will ship a request letter to the organization for the subsidy release.

Step 7: The financial institution will launch the mortgage quantity as soon as they approve your mortgage application.

Step 8: They will disburse the mortgage quantity immediately to your financial institution account or supplier’s account for equipment, equipment or different capital expenditures.

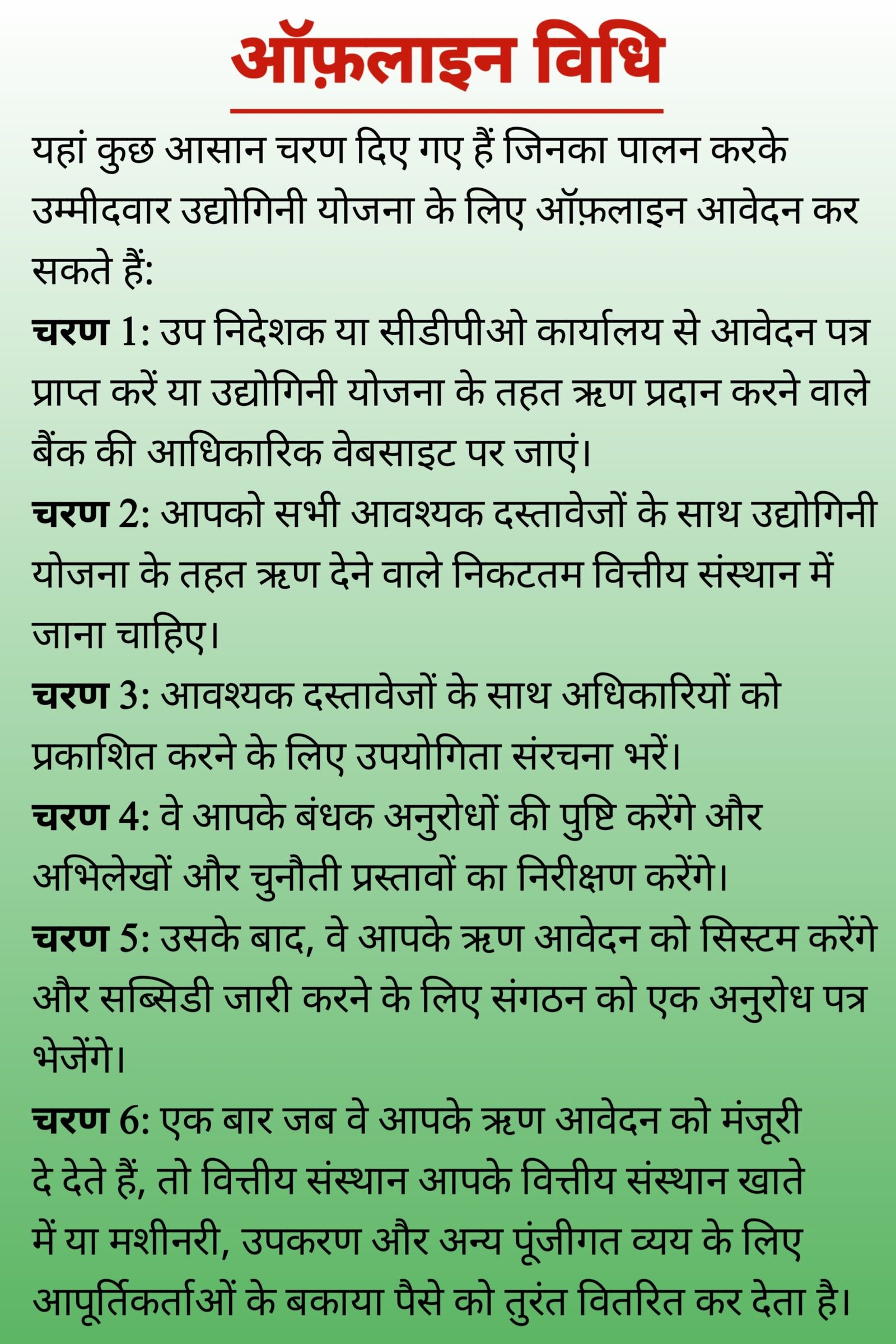

Offline Method

Here are a few easy steps candidates can observe to apply for the Udyogini scheme offline:

Step 1: Get the utility shape from the Deputy Director or CDPO workplace or go to the bank’s authentic internet site that provides loans below the Udyogini scheme.

Step 2: You ought to go to the nearest financial institution that affords a mortgage below the Udyogini scheme with all the required documents.

Step 3: Fill out the utility structure to publish it to the officers alongside with the required documents.

Step 4: They will affirm your mortgage requests and observe archives and challenge proposals.

Step 5: After that, they will system your mortgage software and ship a request letter to the organization to launch the subsidy.

Step 6: Once they approve your loan application, the financial institution disburses the quantity to your financial institution account or without delay to suppliers’ money owed for machinery, gear and different capital expenditures.

You Can Also Read : Post Graduate Indira Gandhi Scholarship

Contact Info

- Helpline Number : +91-9319620533

FAQs

What is the Udyogini Scheme for Women Entrepreneurs?

What are the advantages of this scheme?

What are the minimal eligibility standards for this scheme?

Still have more questions About Udyogini Scheme for Women Entrepreneurs?

If you have any further questions, we are here to serve you. Join the WhatsApp channel by clicking on the button below. Visit our website on daily basis. Our website hindiyojananews.net provides complete details of all the schemes launched by the Indian Government. You can find complete details about all these schemes released by the Indian government on our website Our Website Not A Official Site. We Provide Just Latest News Update About Social Schemes !